The Ultimate Guide to Token Issuance: Bridging Web2 and Web3 for Retail Users and Developers

At Tadle, we’re building a high-performance trading ecosystem that takes advantage of next-generation blockchain infrastructure. We selected Monad as our blockchain of choice due to its parallel execution capabilities, ultra-low latency, and superior scalability, all of which are crucial for high-speed decentralized trading.

But beyond our specific case, I want to share a comprehensive and digestible guide for Web2 developers, retail users, and anyone exploring tokenization. Whether you’re launching a startup, investing in Web3, or simply curious about how tokens work, this guide will help you navigate the rapidly evolving world of token economies.

The Fundamentals: What Are Tokens and Why Are They Essential?

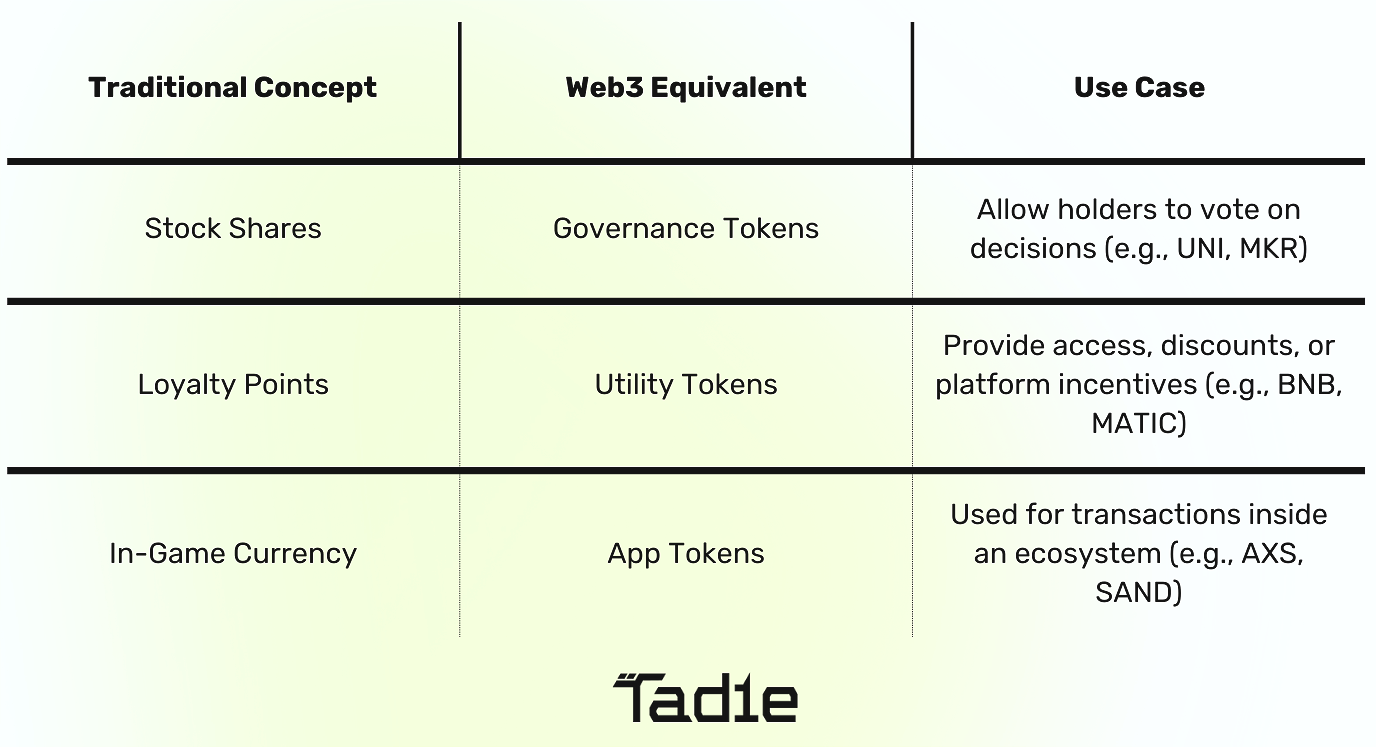

At their core, tokens represent value, ownership, or access in a blockchain ecosystem. Unlike traditional digital assets (such as loyalty points or stocks), tokens operate in permissionless environments, allowing anyone to participate in their economy.

Tokens serve as the foundation for decentralized finance (DeFi), gaming, DAOs, and more. Understanding their mechanics is key to navigating Web3 successfully. For those from a Web2 or retail background, here’s an easy way to understand different types of tokens:

The Do’s and Don’ts of Token Design

✅ Do:

- Define the token’s core purpose: Is it for governance, payments, access, or staking? Every token needs a clear utility.

- Ensure long-term sustainability: Many projects fail because they oversupply tokens early, leading to hyperinflation.

- Create real demand and usage: If users aren’t actively using the token within the platform, it becomes a speculative asset rather than a functional tool.

- Align token incentives with user behavior: Encourage holders to stake, vote, or participate rather than just trade.

- Incorporate decentralization over time: Start with a solid foundation, then progressively transfer governance to the community.

❌ Don’t:

- Overcomplicate tokenomics: Complex models confuse users and investors. Keep it simple and functional.

- Ignore regulatory considerations: Understanding compliance is critical in different jurisdictions.

- Rely solely on speculation: If your token’s only use case is price appreciation, the project will struggle in bear markets.

A token is not just a digital coin; it’s a tool for ecosystem growth.

Structuring Token Compensation: Aligning Incentives with Growth

As we prepare for Tadle’s Pre-TGE, one of our key focuses is integrating tokens into compensation models. Unlike traditional stock options, token-based compensation requires unique considerations:

Key Considerations for Token-Based Salaries:

- Vesting Schedules: Employees should receive tokens gradually over time to ensure long-term commitment.

- Lock-Up Periods: Prevent early dump-offs by delaying unlocks for key team members.

- Taxation: Different countries treat token income differently - having legal guidance is crucial.

- Hybrid Pay Structures: Many startups mix stablecoin salaries + token bonuses to provide financial stability.

For Web2 companies, adopting token-based compensation can align employees with long-term growth.. if done correctly.

Token Rights in Fundraising: How to Protect Your Project

One of the biggest pitfalls in early-stage Web3 projects is poor token-rights structuring. Investors often demand aggressive vesting schedules or control mechanisms that harm the project in the long run.

Best Practices for Token Rights in Early-Stage Fundraising:

- Avoid Over-Allocating Tokens to Investors: Some VCs demand too many tokens upfront, reducing what’s available for future growth.

- Ensure Fair Governance Distribution: Large investors should not have excessive voting power in DAOs or governance structures.

- Use Investor-Friendly Lockups: While locking tokens prevents early sell-offs, overly long lockups can discourage investor participation.

By balancing investor needs and community interests, projects can create sustainable long-term ecosystems.

Application Tokens: Unlocking Real-World Utility

Unlike Layer 1 tokens (ETH, SOL, BNB), which power entire blockchain networks, application tokens serve specific platforms. At Tadle, we’re designing our token to:

- Enable trading discounts for active users.

- Provide governance rights over platform updates.

- Allow staking for fee reductions and revenue sharing.

For Web2 businesses, tokenization can be a game-changer in unlocking new customer loyalty models and monetization opportunities.

Why Tadle Chose Monad as Its Blockchain

A critical decision for any Web3 project is selecting the right blockchain. We chose Monad because:

- It’s insanely fast. With parallel execution, Monad enables high-speed, low-latency transactions, making it ideal for trading.

- It scales efficiently. Unlike Ethereum, Monad reduces congestion, leading to a better user experience.

- It minimizes gas fees. Low fees enable more frequent trading and participation.

For developers and businesses, choosing the right blockchain is as important as choosing the right tech stack in Web2.

Preparing for a Successful Token Launch

Launching a token requires more than just code, it’s about community, liquidity, and execution.

Key Steps in a Token Launch Strategy:

- Build a strong community: Tokens thrive when there’s real engagement.

- Ensure liquidity support: Market makers and exchange listings matter.

- Address regulatory requirements: Non-compliance kills projects.

- Educate your users: A well-informed community is your strongest asset.

For Web2 businesses, a token launch should be treated like a major product launch, not just a financial event.

Final Thoughts: The Future of Tokens for Web2 and Retail Users

Tokens are not just a crypto-native tool, they’re a universal mechanism for ownership, governance, and incentive structures.

At Tadle, we’re leveraging tokenization to create a next-generation trading experience that combines the best of Web2 efficiency with Web3 decentralization.

For Web2 developers and retail users, the key to understanding tokens is to go beyond speculation, focus on utility, governance, and real-world adoption.

How to Get Involved

- Explore Monad: If you’re a developer, check out its capabilities for high-performance trading applications.

- Engage with Tadle: We’re building a community-first project, join us as we redefine decentralized trading.

- Stay Curious: Web3 is still evolving. The biggest opportunities are yet to come.

The future of tokens isn’t just for crypto experts - it’s for everyone willing to explore and build. 🚀

As the co-founder of Tadle, a next-generation trading platform preparing for its Pre-TGE (Token Generation Event), I’ve spent a long time deeply involved in token design, blockchain strategy, and real-world implementation. Being a board advisor at the Chainlink BUILD Program also gives me perspective to understand founders' rationale.

Before this, I worked as the Head Director of BNB Chain at Binance and as Managing Director at Bit2Me, overseeing and supervising countless Web3 projects, from decentralized exchanges (DEXs) to tokenized ecosystems.

One of the most critical aspects of building a Web3 project is understanding how tokens function, not just as tradable assets but as core elements of decentralized ecosystems. The way a token is designed, structured, and launched can make or break a project.

Comments ()